Disclosure: Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

Smart Paycheck Habits Every Nurse Should Practice to Make Their Money Go Further

Are you one of those nurses who patiently wait for their paycheck every 2 weeks? Yup, me too! But aside from just checking and making sure your hard-earned nurse salary hits your bank (to chill for a few days—or sometimes just a few minutes before doing its duty like paying bills huhu), here are the things I do to stretch a little bit out of every paycheck:

1. Always check your paycheck.

This is coming from someone who never used to check their actual paystub because I trusted my employer knew what they were doing. Lesson learned: it’s actually a very good habit. You should know that your employer doesn’t really have your back for these things. If you’re missing money, it’s on you to ask for it. One time when I finally checked, I realized I was missing $400 from my paycheck. I had to file a special form with our HR manager to get that money back. And yes, I’m still waiting for it.

2. Automate retirement and tax-advantaged accounts.

I can’t even call it a routine, because before my paycheck even lands, money already leaves for my 401k, Roth, FSA, and DCSA. They say, “If you don’t even know you had that money, you won’t miss it.” And honestly? It works. I’m forced to live within my paycheck minus those deductions. It’s like forced savings.

3. Direct deposit into a high-yield checking account.

Recently, I realized my paycheck could earn a bit more than just cents while sitting in my old checking account. Now, while it’s chilling, it actually makes enough to buy 2–3 matcha lattes a month (depending on where I’m buying but definitely not at Erewhon). Not bad for simply moving my direct deposit to SoFi’s No Fees Checking & Savings account.

4. Fund my savings goals automatically.

After my money chills in my checking account for a bit, it automatically gets transferred to a high-yield savings account to fund my:

- Emergency fund

- Home repair fund

I specifically use Marcus HYSA because it gives one of the highest interest rates right now. If I don’t touch it for a year, it can yield a nice chunk of extra money. But since these expenses are unpredictable, it’s also easy to withdraw when needed.

Update (9/2025): Since my HYSA rate from Marcus and other online banks I’ve researched is now lower than the rate on my SoFi Checking and Savings account, I’ve started rerouting the money I used to keep in my HYSA into my SoFi account. I simply move my money where it can earn more.

5. Travel fund.

Another account I fund biweekly is my travel fund. While it’s waiting to be spent, the Marcus HYSA gives it a little boost. So when I travel, I get to spend more money courtesy of the interest earned from my HYSA.

Update (9/2025): Since my HYSA rate from Marcus and other online banks I’ve researched is now lower than the rate on my SoFi Checking and Savings account, I’ve started rerouting the money I used to keep in my HYSA into my SoFi account.

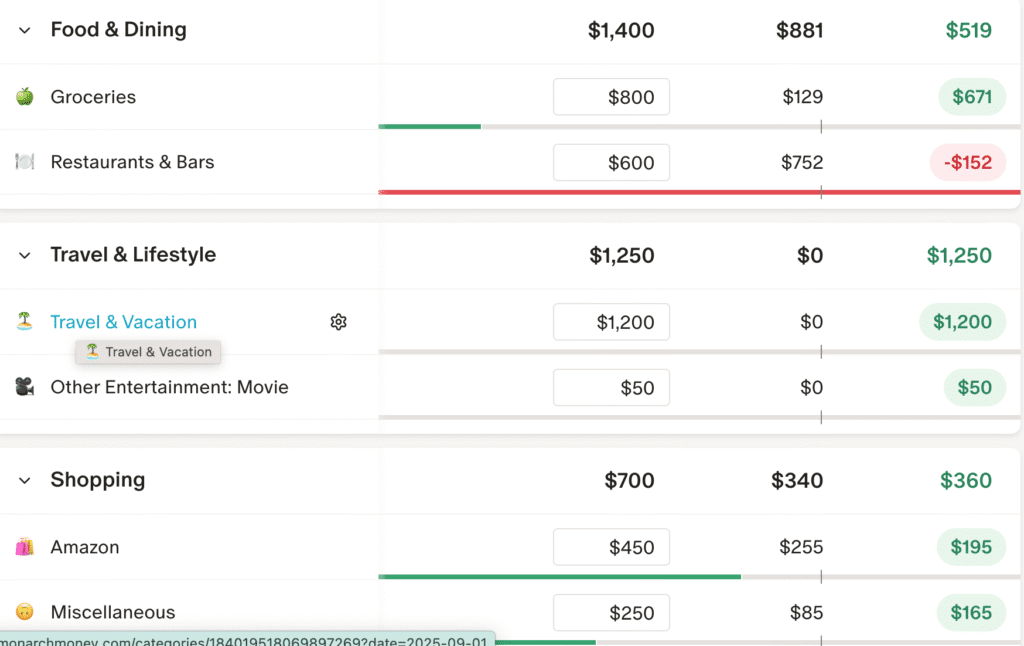

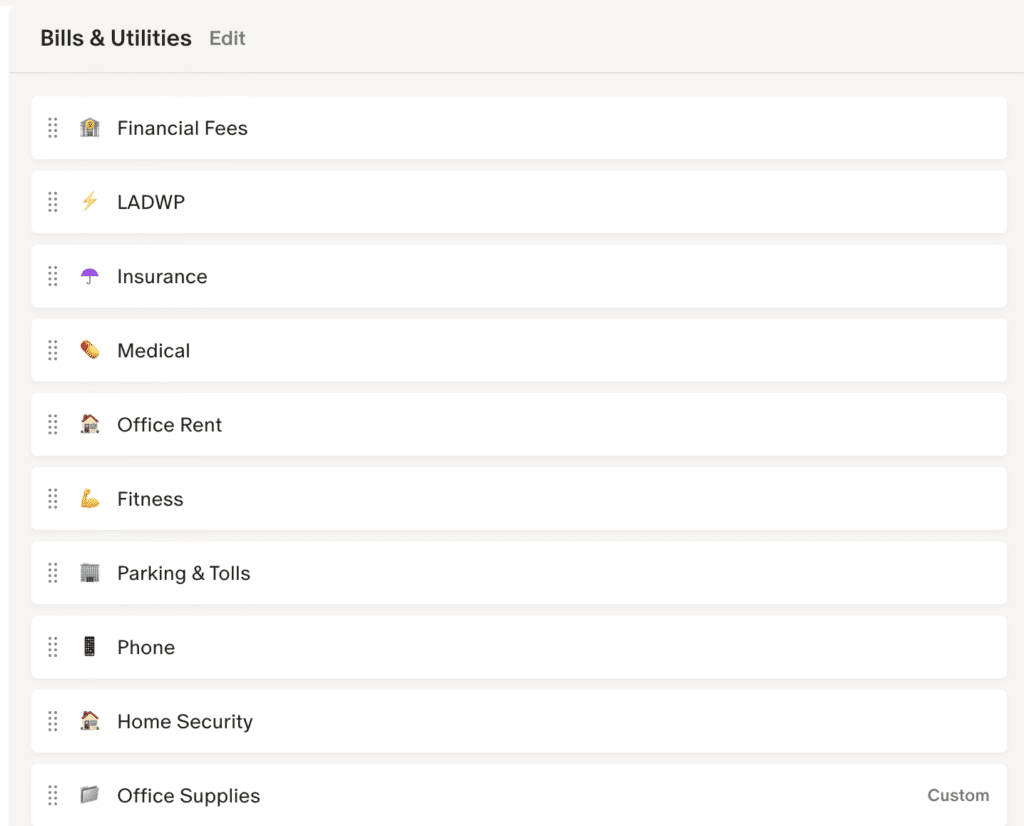

6. Quick glance at my Monarch app.

I check my budget thresholds in the Monarch app, especially mid-month, for flexible categories like groceries, dining out and Amazon purchases. It helps me know whether I still have wiggle room or if I already went overboard.

*Must sign up for the annual plan on web using your referral link.

Final thoughts. That’s basically it. My every 2-weeks payday routine boils down to something simple: check paycheck + automate savings. It works for me because I’m a busy mom, and simplicity is key. Who has time to overanalyze every financial detail of our lives, right? As a PACU Nurse I already juggle hectic work and family life. The simpler and easier you make your routine, the more likely you’ll actually stick to it.