Disclosure: Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

Who Are My Money Influencers as an Aspiring Financially Independent Per Diem PACU RN Nurse?

Let me just start by saying—I’m not a financial expert. I have zero certifications in finance or money management. The purpose of this blog is simple: it’s a journal of my ongoing journey toward financial independence as a registered nurse.

That said, I’ve been fortunate to grow up around financially sensible people. Because of that, when I got my first job as a nurse, I had a pretty solid—not expert-level—understanding of how not to mismanage my salary. I was guided into reading books about personal finance and investing early on, and it made a difference.

1. My Mother

I’m lucky that both my parents, but especially my mom, instilled in me and my siblings the importance of not wasting money on unnecessary stuff. She’s a no-nonsense saver. (Read: The Money Lessons that Shaped My Life). My father worked hard to give us a comfortable life, and whatever was left, they invested heavily in real estate in the Philippines. Frugality runs in their blood—they came from poverty and were determined that their children wouldn’t go through the same. For that, I’m very grateful.

2. My OG Nurse Aunt

When I moved to the U.S. in my early 20s to become a nurse, I lived with my aunt—a veteran RN since the 1980s. She’s a single mom, and also cared for my grandma. Sure, we had some minor scuffles—you know, the usual young-person drama: dating, coming home late, her “overhandling” me as an adult. But looking back? I’m grateful. She forced her financial values on me—work hard, save money, be frugal (almost to the extreme), and invest early. She even made me, my sister, and our cousins go to the library every weekend to borrow and read books about finance. Now at 65, she’s still working (because she enjoys it!) as a nursing school professor. She owns two homes in Los Angeles, sent her daughter to USC with zero student loan debt, and helped her buy two properties before age 25.

3. Robert Kiyosaki

The first book I ever read about money and investing? Robert Kiyosaki’s Rich Dad, Poor Dad. My OG nurse aunt made us borrow it from the library and forced us to read it. I’m so glad she did. I read it over 15 years ago, and some of the advice still holds up. That book taught me: You can work your entire life and still not be wealthy. Comfortable? Maybe. But if you want financial freedom, you need to learn about investing and entrepreneurship. Ever since, I’ve had the entrepreneurship bug—bad.

4. Ramit Sethi- I Will Teach You To Be Rich

Ramit doesn’t sugarcoat. His podcast tone can be a little harsh at times, but I like his message—live your rich life. Be relentless in saving on things that don’t bring you joy, but don’t be afraid to spend money on things that do bring you happiness. For example, I don’t care about designer clothes, shoes, or purses. I buy thrifted clothes, and I’m not ashamed to ask coworkers for hand-me-downs for my toddler. I really don’t care about cosmetics, manicures, pedicures, or hair treatments. If I could cut my own hair, I would—but alas, a $30 annual haircut will suffice. I might look like a hobo when you see me in person, but I don’t care. LOL.

But I’ll happily spend on travel and experiences with my family. Just a few months ago, I treated my three elderly aunties to free flights to Europe to join us on vacation.

5. Katie Gatti- Tassin: Money with Katie

I love Katie. I mostly listen to her podcast while driving. She’s insightful and discusses more than just budgeting—she dives into the larger economic picture of the U.S. Yes, she’s very progressive and left-leaning—which is totally fine by me. I’m super excited for her book to come out this year.

6. Paula Pant – Afford Anything

Another podcast I heavily listen to while driving. Her mantra:

“You can afford anything… but not everything.” That really stuck with me. Like yeah, I can afford most things I want at TJ Maxx—but not everything, lol. What I appreciate most is her level-headed financial advice. She often brings on guests with a ton of practical insight, even for beginners. The show also features listener questions, and it’s helpful to hear diverse perspectives from actual financial experts.

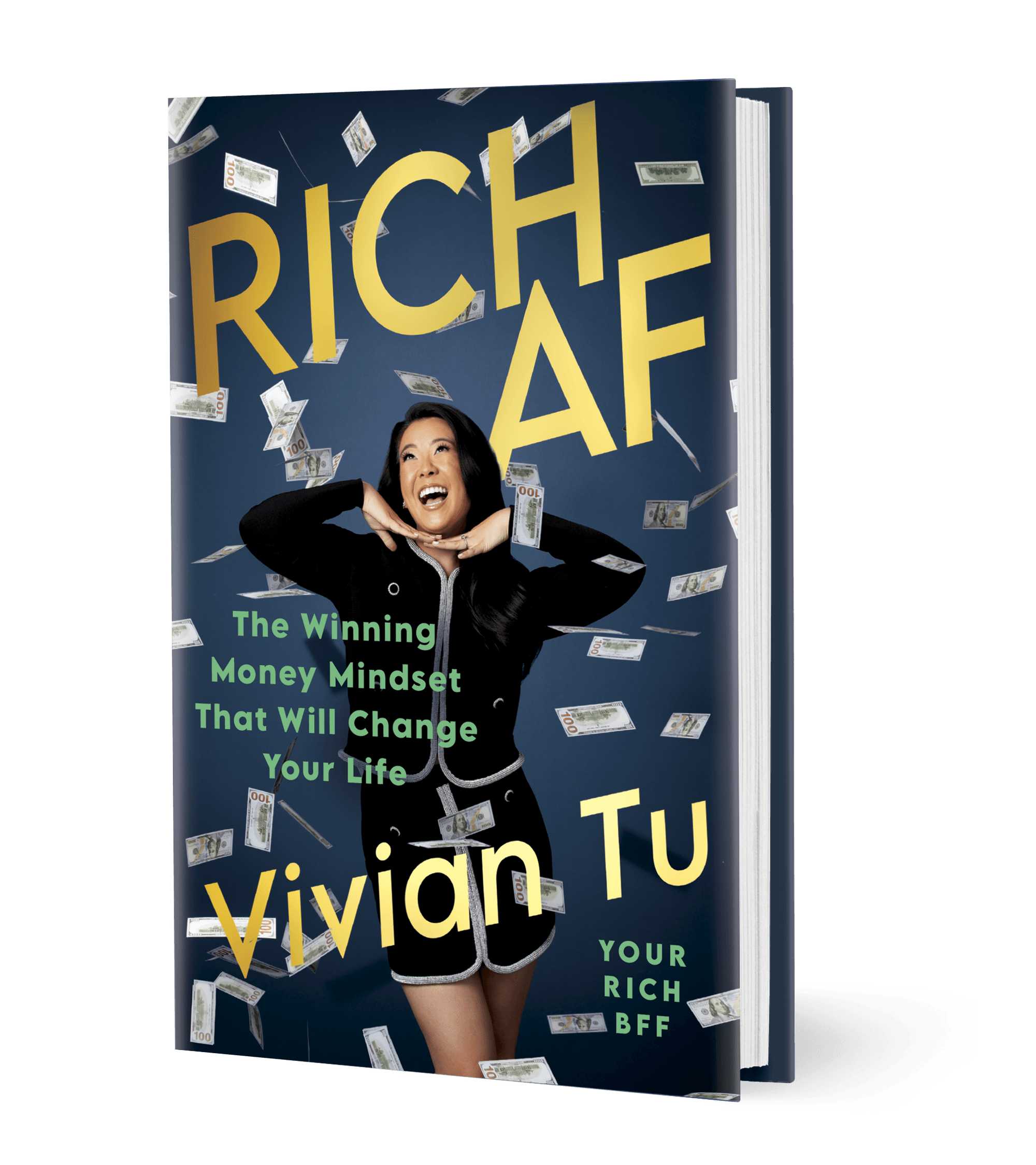

7. Vivian Tu – Your Rich BFF

She’s very flamboyant and flashy when talking about money, which sometimes puts me off. But her book Rich AF: The Money Mindset That Will Change Your Life ? So easy to read. And coming from me—someone who takes forever to finish a book (hello, social media distractions and expert-level procrastination)—that says a lot. The book feels like you’re just scrolling through an informative social media app.

So there you have it—these are the people who’ve influenced (and continue to influence) my financial journey as a registered nurse in the U.S.

I believe there’s a serious lack of financial education in the U.S., especially among healthcare professionals. I see nurses and colleagues working 2 jobs well into their 60s and 70s. That’s not just exhausting—it’s heartbreaking.

Again, I feel incredibly privileged to have been raised around financially sensible adults. But still—I don’t consider myself financially savvy. I’ve had my share of “what was I thinking?” moments. (Hello, $800/month car lease! 😬) But I believe it’s never too early to start learning. We all know as nurses that this profession is not easy—and if you don’t want to be working in your 70s, I suggest to start your financial education now.

Read my other favorite books on money and finance in my Bookshop.org Store: