Disclosure: Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

What Is Lifestyle Creep?

According to Fidelity, lifestyle creep happens when someone gets a raise, bonus, or new job (hello, new grad nurses!) and instead of keeping the same spending habits, they start upgrading their lifestyle because they’re earning more.

The problem? Even though you’re making more money, you end up with less—or no—savings at all.

As a new grad nurse back then, here are the lifestyle creeps I wish I had avoided:

1. Buying or Leasing Expensive Cars

You know what I did? I leased a freaking Porsche back in 2015 because I got overconfident with my side hustle income. Unfortunately, I had to return it after just 2 weeks because I got divorced during that time. Lost my $5,000 down payment.

Then, I did it again in 2022 with an expensive Tesla Model Y lease. Now I’m stuck paying $800 a month for a car I’ll never own. Thank God this lease will be done in a few months.

2. Grocery Overspending and Food Waste

Buying food without a plan or budget. I’d go grocery shopping with no list, overspend, and end up letting food rot in the fridge. I wish I had been more intentional with food—honestly, I’ve wasted so much.

3. Too Much Food Delivery

I used to order food to work at least 3 times a week just because I was too lazy to make food for lunch. Aside from the cost, it was so unhealthy. Eating takeout that often caused me to gain weight—and half of it the food I ordered doesn’t even taste good.

4. Paying for Subscriptions I Don’t Use

Gym memberships, streaming services like Hulu, random apps I barely open. I kept telling myself, “It’s only $10 here and there,” but those little charges add up fast.

5. Buying Things to Impress Other People

My friends loved clubbing and Vegas trips, and I got guilt-tripped into joining even though I didn’t really enjoy those things. I wish I had realized sooner that I don’t have to spend money to fit in—especially on stuff that doesn’t align with who I am.

6. Saying Yes to Every Invitation

Weddings, bachelorette parties, baby showers—you name it, I said yes. Without ever checking my budget.

We all know these events cost money. According to The Knot, the average cost to attend a wedding in 2024 was $610, up $180 from five years ago. And if you’re a bridesmaid? Brides.com says it can cost $1,500–$2,500 for a local wedding—more for destination ones.

7. Having Amazon Prime

This one is my weakness. For me, it’s all about convenience. If something can make my life “easier,” it’s instantly in my cart.

As a busy nurse and mom, I justify it by saying, “It helps me stay organized” or “It keeps my kid busy.” But honestly, it’s caused me to overspend and clutter the house in the name of “making life easier.”

8. Alcohol Upgrades

As I started making more money (and got older), my taste in alcohol leveled up too. Gone were the days of cheap beer and $1 tequila shots—now it’s premium wine and cocktails that cost as much as dinner.

How to Avoid Lifestyle Creep

1. Budget, Budget, Budget

I never used to budget. I thought I was decent with money until I actually started tracking it. Seeing where every dollar goes is a wake-up call.

Without a budget, it’s easy for your paycheck to disappear. Real numbers don’t lie, you need to see how much is coming in, how much is going out, and what’s actually being saved or invested.

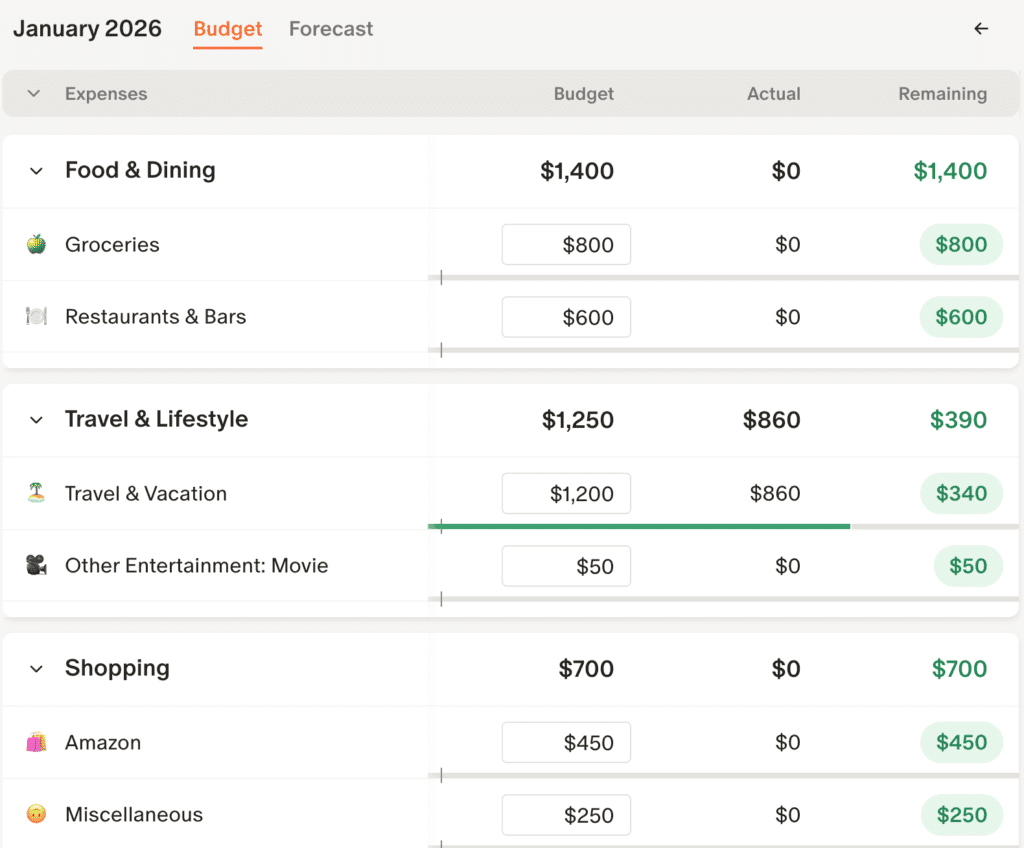

I use the Monarch Money app to create and track my monthly budget. I like it more than other budgeting apps because the spending categories are easy to customize, and it gives a clear visual of where your money is going. It costs $99.36 per year or $14.99 per month.

This is what my actual Monarch Money Budget Dashboard looks like.

*Must sign up for the annual plan on web using your referral link.

2. Set Clear Goals

I wish I had set financial goals early in my career. Even if you’re young and unsure about your future, it helps to have benchmarks.

For example:

- By 30: $500k in retirement + brokerage accounts

- By 40: $1 million total investments

Life gets busy, especially as a nurse juggling work and family. Setting concrete, measurable goals keeps you focused and prevents wishful thinking.

3. Run the Numbers Before Purchasing Anything (For me anything over $500)

People advised me things like, “Lease a car—it’s a tax write-off!” or “You can afford it—you work hard!”

That mindset got me into two expensive car leases with barely any tax write-off compared to the huge cost and some credit card debt. Don’t let guilt or FOMO convince you that you “have to” spend.

4. Be Intentional

Ask yourself: Does this really add quality to my life? Am I buying this for convenience, validation, or genuine happiness?

I’m not perfect, but now I think twice before spending my hard-earned RN salary.

Lifestyle Creep I Still Allow (But Manage Wisely)

Even as a 40-year-old Per diem PACU nurse, I still enjoy a few lifestyle upgrades but I do it intentionally.

Travel – I use credit card points for most flights and sometimes hotels.

Coffee Shop Visits – Once every 2 weeks at my favorite local spot.

Dining Out – Once in a while, at least every two weeks, usually for good sushi, or we go to Los Angeles Koreatown for really good and affordable Korean BBQ.

Grocery Upgrades –I now buy food I actually eat. Trader Joe’s is a godsend for fruits, especially since my toddler eats so many apples. Sometimes I even buy higher-quality, more expensive ingredients from Bristol Farms because it is still cheaper than going out to eat.

Lifestyle creep happens to the best of us, especially when we finally start earning a real nurse paycheck after years of working hard in nursing school. But the good news is you can control it. Being mindful of where your money goes, setting goals early, and budgeting with intention will help you actually keep and grow the income you work so hard for.

So yes, treat yourself once in a while because you deserve it, but remember your future self will thank you more for saving than spending.

Sources:

https://www.fidelity.com/learning-center/personal-finance/lifestyle-creep

https://www.theknot.com/content/wedding-guest-cost

https://www.brides.com/cost-of-being-a-bridesmaid-2025-11702605