Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

I’ve been a Per Diem RN in Los Angeles since 2018. Coming from severe burnout after working 4.5 years as an ICU nurse in a county hospital, I impulsively quit my full-time job and took a six-month sabbatical. When I returned to nursing, I stumbled upon the wonderful specialty of Ambulatory Surgery Nursing.

For the first few years of working as a Per Diem nurse, I worked 2 8-hour shifts per week because I had a fledgling side hustle that was making me almost as much as a full-time salary. But in the last two years, with less income from my side hustle and the additional expense of having a baby, I’ve been picking up more shifts. Now, I work almost full-time hours—around 32 hours per week. It’s a Monday-to-Friday job, so I don’t work weekends and mostly no holidays.

The Pros and Cons of Being a Per Diem Nurse

Being a Per Diem nurse comes with both pros and cons. Read: Is Per Diem Nursing for You? One major upside is the flexibility—you can choose when to work—and the higher hourly rate. However, the major downsides are the minimal sick time, no vacation days, and income fluctuations.

Being an RN in Los Angeles

Being an RN in Los Angeles can be an amazing gig. The salaries here are higher compared to other cities outside of California (except San Francisco and surrounding Nor Cal cities), the weather is gorgeous year-round, and most hospital employers are unionized, so as a healthcare worker, you’re well protected.

But with all that, you can expect a high cost of living and high taxes, which take a huge chunk of your paycheck.

Read: How I Lower My Taxes (Legally) as a Per Diem PACU Nurse

My Personal Situation

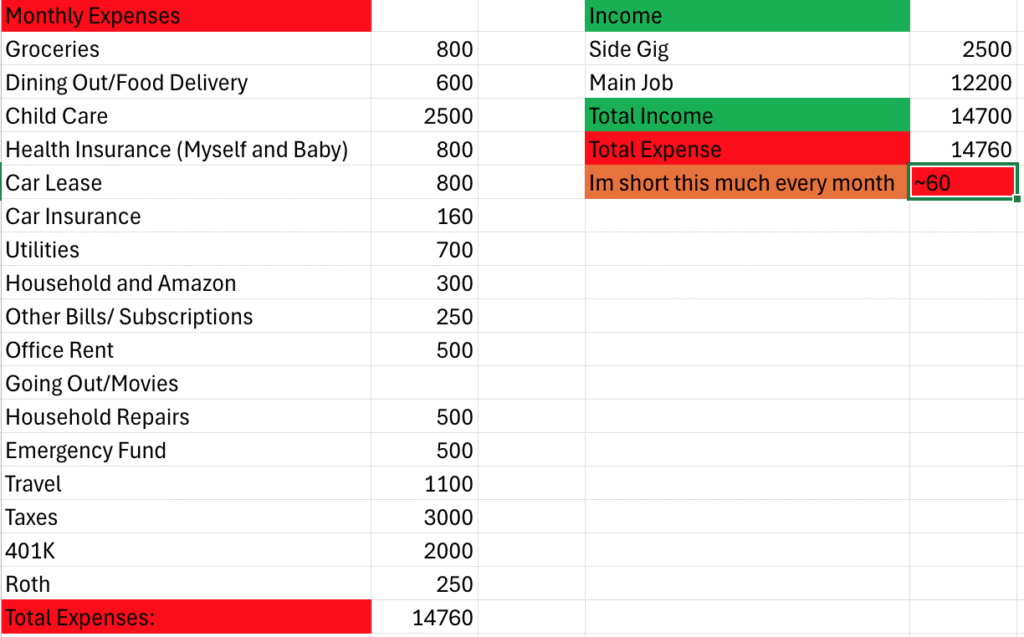

To give some context on how I budget my salary as a Per Diem nurse in Los Angeles:

- I make $92/hr as a Per Diem RN and work 128 hours/month

- I live in a HCOL state.

- I have a domestic partner (not married), and we share one toddler.

- We do not have combined finances—he has his own bank accounts, retirement, etc.

- My partner owns the home we live in. I do not contribute to the mortgage or mortgage-related costs.

- I make $2500/month from a consulting side gig.

- I have an $80,000 emergency fund that I keep in my SoFi HYSA and Checking account, earning up to 4.50% APY (Updated 9/26/2026). I always move my money where it will earn the most for me.

- I do not have any debt.

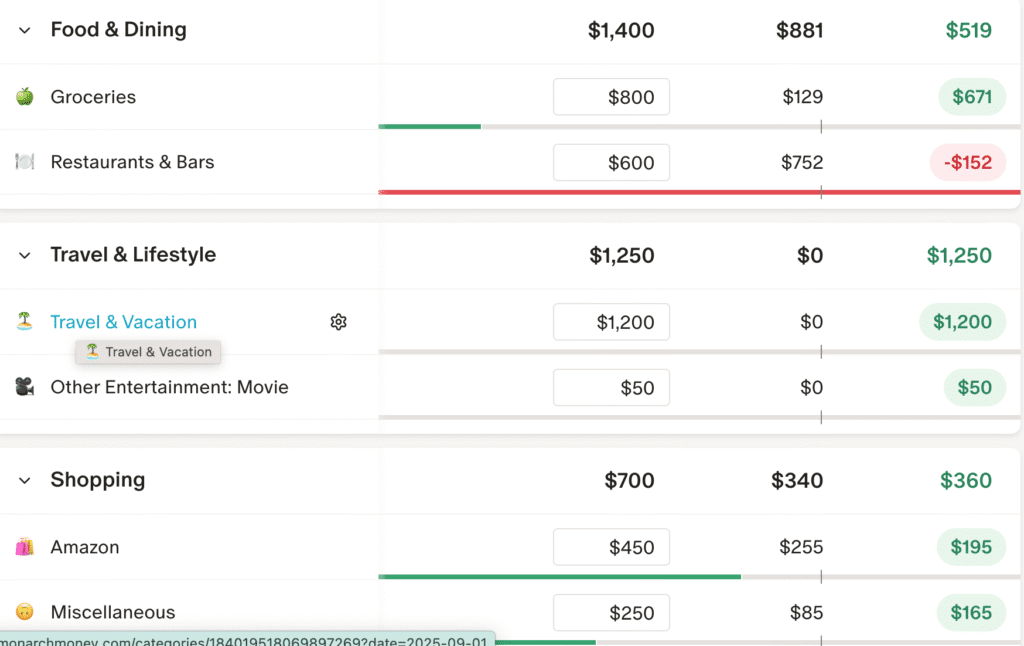

(Updated 9/2025) I started using Monarch Money app to manage my budget instead of manually updating everything in Excel. What I like about this app is that it’s very easy to customize categories based on my own circumstances and expenses.

I also like that I can easily track how close I am to hitting my budget limits especially for groceries, eating out/dinners, and Amazon, which are the easiest areas for me to overspend on.

*Must sign up for the annual plan on web using your referral link.

My Budget

Groceries ~$800/month

I typically spend around $175–$200 per week on groceries for two adults and one toddler. I shop at Ralphs, Trader Joe’s, and sometimes a local Asian market, 99 Ranch, for more selection of meats, produce, and Asian products. Groceries have definitely become more expensive in Los Angeles, so I mostly buy essentials now and have cut back on snacks and wine.

For everyday wine, I get it from Trader Joe’s—they have a few reds under $10 that hold up well against pricier options. For special occasions, we enjoy wines from our Wine.com membership. It’s not cheap, but it’s better than spending on a bottle of wine at a fancy restaurant.

Dining Out & Food Delivery ~$600/month

Before having our toddler, our spending on dining out and food delivery was outrageous. We’ve since deliberately cut back.

A few days ago, my partner and I were both too tired to cook, so we ordered Shake Shack via DoorDash. Two burgers, two fries, one strawberry shake, and one 10-piece chicken bites came out to $72.77—plus $30.32 in delivery fees, service fees, tax, and a Dasher tip.

That’s over $100 for a fast-food meal for two people. Food delivery in Los Angeles has gotten that expensive, which is why we rarely do it.

But one thing we still splurge on is dining out. LA has a solid food scene, and we try not to miss out. We go out to eat at least once a week—mainly to break the monotony of work and cooking and to get some alone time away from our toddler.

We love sushi, so we get it at least twice a month from our favorite spot in LA. Other times, we try new restaurants with good reviews from Restaurant.com, which offers dining discounts.

To make my $600/month dining out budget work, my partner and I alternate picking up the bill. A typical meal for two at an upscale LA restaurant can cost $250–$300 (including tip).

Childcare ~$2500/month

My biggest expense. I pay a relative to watch my toddler full-time, Monday through Friday. Even at this rate, it’s still low compared to LA’s typical childcare costs, where rates can be $30–$40/hr. At those prices, I might as well be a stay-at-home mom.

When my child turns two (in just a few months), I plan to transition to daycare, which is cheaper, or hire an au pair.

Health Insurance ~$800/month

One of the worst parts of being a Per Diem nurse is having to pay for healthcare. I pay $800/month for health insurance for myself and my toddler. I have the Kaiser Gold Plan, and the cost increases every year. My partner gets his insurance through his business, but adding me and our toddler doesn’t make sense financially.

Honestly, this cost alone is making me consider switching from per diem to part-time or full-time just to access employer-sponsored health insurance.

Car Lease ~$800/month

This was a classic dumb move on my part. Feeling confident with my finances, I leased a Tesla Model Y in December 2022. Now, I’m paying $800/month for a lease, while the same car can be leased for $250/month today. I don’t know what caused the price drop, but I’m not happy. I love my car, but I can’t wait for my lease to end in December 2025 so I can get something cheaper.

Car Insurance ~160/month

I pay $200/month for auto insurance through Tesla Insurance Services. Honestly, that’s not bad for California, considering AAA quoted me $395/month for the same coverage.

Utilities (LADWP) $650-700/month

Our water, power, gas, and sanitation bill from LADWP comes every two months and averages $1,200–$1,300—so about $600–$700/month. That seems insanely high for a 1600 sq. ft. home with just two adults and a toddler.

I suspect it’s because I charge my car twice a week. I’m seriously considering getting solar panels to cut down costs.

Household & Amazon ~$300/month

This category is dangerous because Amazon is basically on my speed dial.

Half of this budget goes to household staples I have on subscription—things like dish soap, paper towels, and hand soap. The rest? Probably overspending on skincare and toddler stuff.

Other Bills & Subscriptions ~$250/month

Includes Netflix, Hulu, Disney+, personal phone line ($91/month with Verizon), business phone/fax, and annual membership fees.

Office Rent ~$500

I was planning to sell my investment business in 2022, but things changed, and now I’m stuck paying for an office lease until 2026. This one hurts.

Going Out/Movies ~$0/month

It’s so rare now for my partner and me to go to the movies or do anything outside of our weekly dinner out because of our toddler. So, this budget usually gets combined with our dining/eating out budget.

Emergency Fund ~$500/month

Shit sometimes happens—or in my case, almost every month.

- My parked car got hit, and I had to shell out $1,500 for the deductible + rental fees.

- Emergency room visits for my toddler with a $350 copay per visit.

If I don’t end up using it, I transfer whatever’s left into my SoFi HYSA and Checking account so it can earn more while it just sits there (hopefully untouched).

I wish to be able to increase my budget for emergency expenses each month because it feels too low with all the unfortunate out-of-pocket stuff I’ve had to cover lately. The plan is to avoid dipping into my emergency fund unless it’s a truly dire situation.

Household Repairs ~$500/month

For fixing bathrooms, broken appliances—basically, not fun stuff.

Last year, after years of no major renovations, I finally spent $20,000 to update our home:

- Replaced old, grimy tile with laminate floors.

- Updated our kitchen

I justified this spend because coming home to a beautiful space genuinely helps my mental health, especially since my partner and I cook a lot. We probably won’t be doing any major home renovations in the near future.

Travel ~$1100/month

This might seem like a high expense, but travel keeps me sane.

We travel internationally twice a year for about two weeks, plus one week in North Carolina and one week in Pennsylvania to visit my in-laws. Thank God most of our airfare (and sometimes hotel stays) are free thanks to credit card points. I usually only pay for the airfare taxes. Lol. Just a warning: do not fly out of London because the taxes are huge. I once paid $600 per person for a reward Virgin Atlantic Business Class flight.

My favorite credit card that keeps on giving:

Capital One Venture Card

Earns 2x points on every purchase.

Super simple to use with no category restrictions.

*Terms apply. Visit capitalone.com

One big reason this category is expensive? I bring my aunt (who takes care of my toddler) when we travel. I pay for her flights and sometimes an extra hotel room.

As our toddler gets older, I expect this cost to drop since we won’t need as much help while traveling.

Taxes ~$3000/month

I’m basing this on how much is taken out of my paycheck every two weeks—about $1,500. It hurts to look at.

Last year (2024) was the first time in years that I had a steady W-2 income, and during tax season, I actually received a refund. So, we’ll see. Obviously, I still have a lot to learn about taxation.

Retirement Accounts ~$2250/month

- 401(k): I contribute $900–$1,000 per paycheck, ensuring I max out my yearly contributions. My employer offers a pension and a yearly bonus (around $4,000–$5,000 for full-time employees)

- Roth IRA: Around $200 per paycheck.

What I’m Planning to do to Improve My Finances

✅ Switching from per diem to part-time for free healthcare ($1,600/month savings!)

✅ Cutting down childcare costs by transitioning to daycare/au pair

✅ Cheaper car lease once my Tesla contract ends in December 2025

✅ Figuring out why LADWP bills are so high—possibly installing solar panels

✅ Reducing travel expenses as our toddler requires less help

✅ Figuring out how to lower my taxable income thru tax advantaged accounts.

✅ Work on increasing side hustle income.

Final Thoughts

Even as a high-earning nurse, I sometimes feel like I’m living paycheck to paycheck. Creating this budget breakdown really helped me see where I can cut back and be more mindful about spending.