Disclosure: Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

Best Financial Accounts for Nurses to Grow Savings and Build Long-Term Wealth

When I started my journey toward Financial Independence as a Per diem PACU nurse, I learned that it’s not enough to just earn a paycheck and leave it in a checking or savings account hoping it will outpace inflation. It doesn’t.

Below are the financial accounts I use to make sure my hard-earned money is working for me—and not just sitting idly in a bank account that doesn’t grow.

1. No-Fee or Low-Fee Checking Account that Rewards Your Money

For years, I had my direct deposit going to a big-brand bank. It wasn’t terrible—I liked their mobile app, online access, and the convenience of branches almost everywhere in the U.S.

But like most big banks, that account paid me pennies for parking my money there (while they turned around and loaned it out at much higher rates).

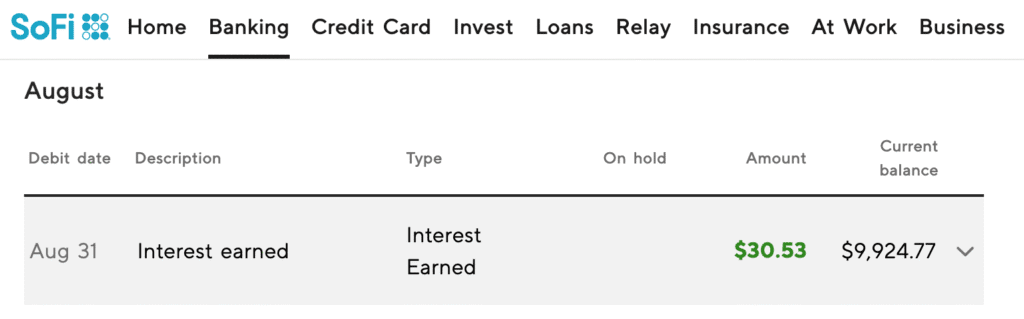

Recently, I started exploring other options that would at least give me something meaningful—enough to buy me 3–4 matcha lattes a month. That’s when I found SoFi Checking and Savings account and switched because of their promo (as of 9/4/25):

- 3.30% APY + 0.70% bonus (limited time only) *see terms = 4.0% APY (updated: 12/25)

- No fees, as long as I have direct deposits totaling $5,000/month

Just last month, after moving my direct deposit to SoFi, I earned $30 in one month. It’s not a lot, but definitely better than just earning cents.

2. High-Yield Savings Account (HYSA)

To grow my emergency fund while keeping it accessible, I use a HYSA. I started with Marcus HYSA in March 2023 with a $75,000 deposit at 4.44% APY. Since then, their rates have fluctuated between 3.80%–4.40% and are now at 3.65% (as of 9/14/25).

Even with some withdrawals, my emergency fund has earned me around $4,944 in interest since March 2023—all FDIC-insured up to $250k. Not bad for money growing while I sleep.

Update (1/2026): Since the HYSA rate for Marcus dropped to 3.65% as of 1/2026, I rerouted my savings and kept everything in my SoFi checking and savings account to keep things simpler, since the rates don’t have that much difference anyway.

3. Cashback or Rewards Credit Cards

In the last few years, I’ve gotten into credit card rewards and churning. I’m no expert, but points have allowed me to book flights I never thought I could afford. Just recently, my partner and me flew on a round-trip business class flight from LAX to Europe, plus covered tickets for my three aunts. Paying cash for that would’ve been impossible.

Personally, I prefer points over cashback. Points buy me luxury travel—cashback usually just gives a small rebate. But it really depends on your lifestyle.

My go-to cards:

- Amex Gold: 4x points on groceries and restaurants (pro tip: hotel restaurants don’t count as restaurants, learned that the hard way).

- Capital One Venture: 2x points on everything else—perfect for bills, utilities, and recurring payments. I try to charge almost everything to this card that accepts credit card payments (aside from restaurants and groceries) because I try to get points for everything lol.

What I also like about this card, aside from no categories for earning points:

- Easy point transfers since they’re partnered with major airlines and hotel brands

- Capital One shopping portal for savings and accelerated points earning

- Priority Pass lounge access

*Terms apply. See Capital One.

Important disclaimer: Rewards only work in your favor if you pay your balance in full every month. Otherwise, the interest wipes out any gains.

4. Tax-Advantaged Retirement Accounts (401k & Roth IRA)

As nurses, we can’t work forever. A 401k is a no-brainer:

- Lowers my taxable income

- My employer matches 1.25% of my base salary (free money)

I’ve been contributing for 17 years. Every paycheck, my contribution is automatically deducted—money I don’t see is money I don’t miss.

The Roth IRA is another powerful account. Contributions grow tax-free and can be withdrawn tax-free after 59½.

Read:

How I Lower My Taxes (Legally) as a Per Diem PACU Nurse

5. Brokerage Account

Not essential if you’re maxing out retirement accounts, but I opened one after selling a business in 2022 and getting a nice windfall.

After funding a 6-month emergency fund, I invested the rest through Vanguard ETFs in a taxable brokerage account. It’s riskier than a HYSA but offers higher potential returns.

Just remember: this is a taxable account, so you need to understand capital gains and tax implications.

6. Term Life Insurance

This isn’t an investment—it’s income protection and peace of mind.

When people tell me whole life insurance is “better than a 401k,” I honestly want to walk away.

I pay $45/month for $1 million in coverage for 20 years (started at age 40, so it’s pricier). The goal is simple: if I die before my son turns 22, he’ll have $1 million to cover expenses. It’s not about creating generational wealth—it’s about protecting dependents during their dependent years.

Check out Policygenius to compare quotes for affordable term life insurance.

Final Thoughts

These are the financial accounts I use as a Per Diem PACU nurse in Los Angeles to stay ahead.

As much as I enjoy nursing (for now), what I love even more is knowing my RN money is working extra hard for me—growing, compounding, tax-advantaged, and protecting my loved ones. And eventually, sooner rather than later, it will make me a financially independent nurse.