Disclosure: Some of the links on this site are affiliate links. This means that if you click on the link and purchase an item, I may receive a small commission at no extra cost to you. I only recommend products and services that I personally use, trust, or believe will provide value.

Definition of Financial Independence

Financial independence basically means not having to work for money. It means having enough money saved so it can sustain your current or future lifestyle without having to actively work to earn an income. Financial independence, in its most basic sense, means having enough money saved across retirement accounts, savings, and other investments so you can withdraw funds without worrying about them running out.

If you plan to make that money last for a very long time, which for most people means 30 years or more, this usually involves using an important guideline called the 4 percent rule, also known as the safe withdrawal rate.

Read: What Is the 4 Percent Safe Withdrawal Rate?

Why It Is Probably a Good Idea to Learn About Financial Independence as Nurses

As we all know, nursing is not a walk in the park. It is physically and mentally demanding work. My main and very obvious reason for becoming interested in Financial Independence is that even though I love working as a nurse, I do not want to rely solely on my nursing income until I’m 65 or feel forced to work full time right up until retirement. Honestly, that thought feels horrible to me.

What I want instead is options. The option to retire early, to work per diem or part time, or to fully walk away when I’m done, and not because I have no other choice.

Every once in a while, a thought crosses my mind. What if I could simply leave, pack my family’s bags, move to Mallorca, one of the most beautiful places I have ever seen, and not have to worry about being financially destitute or having to go back to work a few years later? A girl can dream, right?

“Even though I love working as a nurse, I do not want to rely solely on my nursing income until I’m 65 or feel forced to work full time right up until retirement.”

Joy RN

At its core, Financial Independence is about planning for the future. It can help soften the impact of unexpected life events such as disability, periods of unemployment, or other unfortunate circumstances. More than anything, it provides a sense of financial security, along with flexibility and choice. Knowing that you are not solely dependent on physically working to sustain a comfortable lifestyle can significantly reduce money related stress and free your mind from constant worry about finances.

Even if you are just starting your journey toward financial independence, simply understanding the concept can help you begin planning and give you a sense of direction. For new nurses especially, it can provide a sense of control over how you want to navigate your nursing career, whether early retirement is a goal or not. Ultimately, it gives you valuable flexibility and options in your career.

The Building Blocks of Financial Independence

When you look at the core elements of financial independence, you will come across many different concepts. For simplicity, I am focusing only on what I believe are the most important foundational building blocks, especially for anyone just getting started.

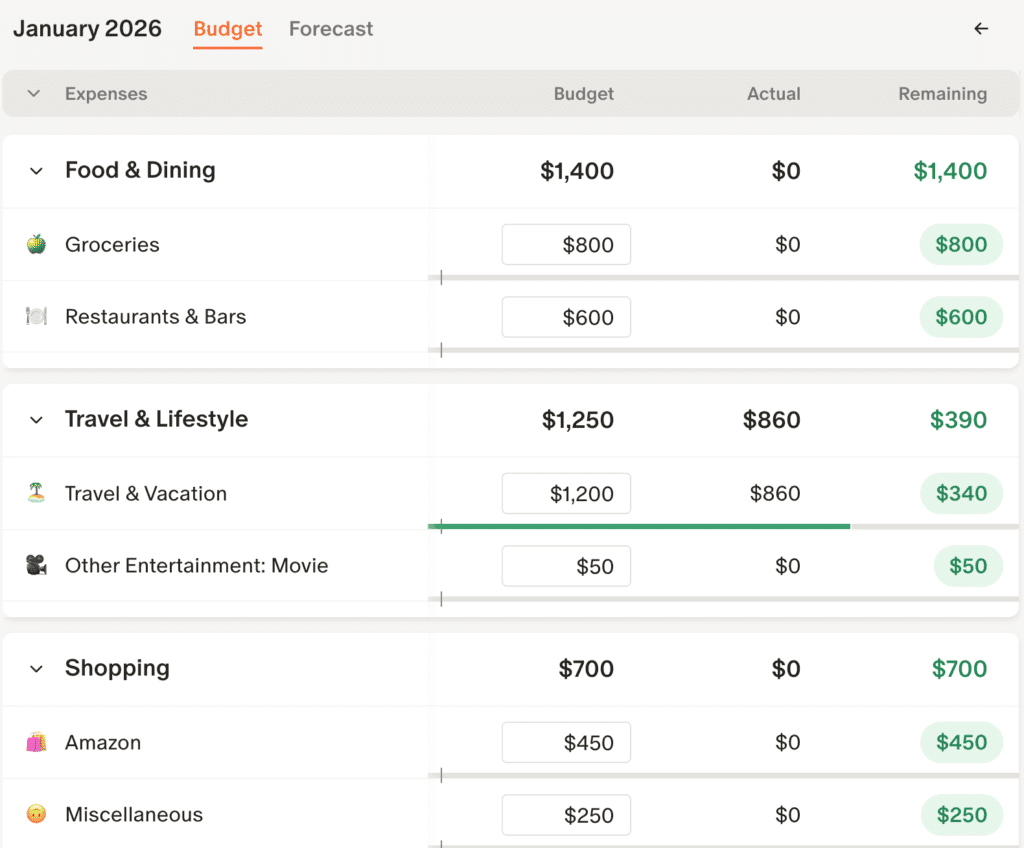

1. Tracking spending and budgeting

You really can’t start this FI thing unless you know your numbers, meaning you understand exactly what is going out as expenses versus what is coming in as income. When I finally sat down and looked at all my monthly expenses, it was honestly shocking how much unnecessary spending such as takeout, eating out, Amazon purchases, and subscriptions was quietly and insidiously wrecking my financial life.

After facing that hard truth of not being a trust fund baby, it was clearly time to create a budget. Out of all the budgeting apps I have tried, I have actually stuck with Monarch. I like it because it is easy to use, especially as a non techie person. Best of all, the customization features help me stay focused on the specific expenses I need to control, particularly eating out, groceries, and Amazon shopping.

*Must sign up for the annual plan on web using your referral link.

2. Building an emergency fund

A real example of why emergency money matters happened this year after a scary car accident. My car was towed and impounded, and in the stress of the moment, I agreed to a random towing company that took my car to a very shady impound lot in Los Angeles. The next day, I realized I had to retrieve my car immediately or it would start accruing daily impound fees. I ended up having to pay $3,000 upfront just to get my car back. Thankfully, I had emergency savings, because without it, the fees would have continued to pile up.

Having a solid emergency fund prevents you from resorting to exploitative options like credit cards or payday loans with excessive fees. It creates a financial buffer and sense of safety when unexpected expenses hit.

I try to keep at least three months of expenses as my emergency fund. This number depends heavily on your situation. If you have kids or are in a single income household, you likely need more. To make my emergency reserves work while still staying accessible, I keep them in a high yield savings account. I currently keep mine in a SoFi savings account, earning up to 3.30 percent as of 12/31/2025.

3. Saving and investing money

Once you have set aside money for emergencies, you are finally ready to step into the realm of Financial Independence.

Saving and investing are often used as if they are the same, but they are actually different, and each plays an important role in building long term financial security.

You can read more about what I am currently saving and how I am investing here.

4. Maintaining or increasing income

It is hard to save and invest if you do not have money coming in from income, so this part is a no brainer.

Nursing is a great career, albeit not an easy one, but it does pay the bills.

I am no expert in side hustles, but I do have a few tips on how nurses can make more money, which you can read here.

5. Spending less than what you earn

At its core, this simply means your expenses must be lower than your income. Spending less than what you earn allows you to build savings, invest consistently, grow your net worth, and ultimately move toward financial independence.

While the concept sounds straightforward, it is often difficult in practice. With the rising cost of living and how easy it is for nurses to fall into lifestyle creep as income increases, maintaining this balance can feel like an uphill battle.

Read: Lifestyle Creep to Avoid as a New Grad Nurse

There are many more elements to financial independence, but I believe anyone starting out should first be familiar with these basics. From there, you can move on to more intermediate concepts such as tax advantaged accounts and different types of investment accounts.

Financial Independence Is Personal

Financial independence is not just for people who are already wealthy or extremely high earners. It is for anyone who wants to gain more control over their finances and their life. Learning basic financial concepts is a powerful first step, and that is exactly how I started as well.

I am not even halfway through my journey, but simply starting has already given me a sense of control and hope for an improved financial future for myself and my family. Financial independence is also not rigid or linear. You can pursue it in a way that aligns with what matters most to you and what you value.

In the end, Financial Independence should provide financial flexibility and options.

Read: How I’m approaching FI as a Nurse